The world is in the middle of a rare earth mineral supercycle that few executives asked for. As the markets scale, demand for magnet rare earths is projected to roughly triple between now and the mid-2030s, with clean energy applications taking an ever larger share.

Supply, however, is not keeping pace—and it is not diversified. China currently dominates rare earth mining, processing, and magnet manufacturing. Most strategy conversations default to one answer: more mines, in more countries.

There is no realistic path through the 2020s and early 2030s that does not involve additional primary production.

However, “urban mining” is almost entirely underused.

Global e-waste volumes are rising steadily, yet only a modest share is formally collected, and an even smaller fraction is processed in ways that recover rare earth elements. By most estimates, less than 1% of global rare earth demand is currently met from recycled sources.

This article argues that urban mining will not eliminate the need for new rare earth mines in the near term—but it is the only strategy that scales with the technologies driving demand.

We quantify the size of the emerging urban ore body, examine how much rare earth supply it could realistically provide under different recycling scenarios, and outline what businesses and policymakers need to do in the 2030s to unlock its full potential.

💡 Key Takeaways: Urban Mining and the Rare Earth Crisis

- Urban mining is the only rare-earth lever that scales with clean-tech growth, turning end-of-life products into new supply.

- Today it provides less than 1% of rare earth demand, even though the material already locked in devices, EVs, and turbines is large enough to be strategic.

- Companies that invest now in robust collection and magnet-recycling capabilities will be better protected from supply shocks, new regulations, and price volatility.

What Exactly Is the Rare Earth Crisis?

The rare earth crisis is the growing geopolitical and economic risk that supplies of rare earth elements (REEs) needed for electronics, electric vehicles, defense, and clean energy can be suddenly disrupted or made very expensive.

Because China dominates mining and processing, it can use export limits or trade moves to cause shortages and price spikes for other countries.

Recent trade tensions have sharpened fears about this dependence and pushed governments to seek alternative sources.

Demand Is Exploding

Rare earth elements (REEs) are essential for high-performance permanent magnets in:

- AI hardware

- Data centers

- Consumer electronics

- EV motors

- Wind turbine generators

- Defense systems (radar, guidance, actuators)

📌 Key trend: magnet rare earths (Nd, Pr, Dy, Tb) are on track to ‘triple’ in demand by 2035.

McKinsey estimates magnetic REE demand rising from about 59 kt in 2022 to ~176 kt in 2035, with clean-energy applications driving most of the growth. Other scenarios, including the IEA’s Net Zero pathway, similarly show total rare earth demand more than doubling between 2023 and 2040, with magnets for clean energy becoming the dominant segment.

Supply Is Hyper-Concentrated

Despite many “rare earth juniors” around the world, effective supply is still dominated by China:

China accounts for around 60–70% of rare earth mining and ~90%+ of separation and refining, plus ~90–98% of magnet production depending on the estimate.

Recent export controls on selected critical minerals and magnet products highlight how quickly this concentration can translate into real supply risk. Several industry and analyst forecasts now point to potential supply gaps of around 30% for magnet rare earths by 2035 under current investment trajectories.

Environmental and Social Externalities

Primary rare earth mining and processing are:

- Highly chemical- and water-intensive

- Often associated with radioactive and toxic waste streams

- Frequently located in regions with weaker environmental oversight

🎯 So the rare earth crisis is three-fold: (a) fast-growing demand, (b) extreme geographical dependence, and (c) high environmental footprint.

What Is Urban Mining in the Rare Earth Context?

Urban mining refers to the recovery of metals from man-made stocks—such as e-waste, end-of-life vehicles, wind turbines, and industrial equipment—rather than from natural ore deposits.

In the case of rare earth elements, the main “urban ore bodies” are high-performance magnets, particularly neodymium–iron–boron (NdFeB) and other REE-containing magnets embedded in:

- Hard drives, audio equipment, and industrial motors

- Electric-vehicle and hybrid traction motors

- Wind turbine generators

There are also opportunities in certain catalysts and polishing compounds (notably for light REEs such as La and Ce), but in economic and strategic terms, magnets are the primary target.

As adoption of AI, data centers, EVs, wind turbines, and electronics accelerates, the quantity of rare earths locked in these in-use products continues to grow—meaning the “urban mine” is becoming richer and more geographically widespread over time.

🎯 Urban mining = recovering materials from existing electronics (e-waste, end-of-life EVs, wind turbines, motors, etc.) instead of from ore.

How Much Is in the Urban Mine, and How Much Do We Recover ‘Today’? Analyzing the Numbers

Size of the E-Waste Mountain

Global e-waste volumes are already substantial and growing quickly.

Around 62 million tons of e-waste were generated in 2022—an increase of more than 80 percent since 2010—and on current trends this is expected to reach roughly 82 million tons by 2030. Yet only about 22.3% of this mass is formally collected and recycled in an environmentally sound manner.

Current estimates suggest that no more than ~1 percent of rare earth demand is met via e-waste recycling.

In other words, the system is generating a very large potential feedstock, but almost none of it is being tapped for rare earth elements.

How Much Rare Earth Is in That Pile?

Several lines of evidence:

- UN-linked analysis suggests that ~7,000 tons of neodymium were present in 2022 e-waste—enough, in principle, to cover a significant share of projected neodymium demand for wind energy in 2030 if fully recovered.

- A Danish Technical Institute synthesis of UN data estimates that roughly 7,200 tons of rare earths are lost each year in discarded electronics.

- A Brazilian case study finds that about 211 tons of REEs (mainly neodymium) could be recovered from end-of-life magnets in mobile phones and hard disk drives in Brazil alone.

🎯 Taken together, these figures indicate that the urban mine is already large enough to be strategically relevant—at least on paper.

Actual Rare Earth Recycling Today

Despite the size of the urban mine, very little rare earth material is actually recovered today.

Even when e-waste does go to a proper recycler, rare earths are rarely the priority. Conventional processes are designed to capture easier, higher-value materials like copper, gold, and aluminum.

The rare earth content per device is small and embedded inside components, so it is usually shredded, diluted, and lost rather than separated out.

So right now, urban mining is not solving the crisis; it’s barely visible in the numbers.

Future Flows: When Does Urban Mining Really Kick In?

Urban mining is ultimately about future scrap flows. The key question is not just how much rare earth metal we use, but when and where it comes back as waste we can actually process.

Two trends matter most:

- The rapid buildout and short refresh cycles of AI and data center hardware

- The slower, high-mass turnover of EVs and wind turbines

Together, they shape when urban mining becomes a meaningful source of rare earth supply.

AI and Data Centers: The First Big Scrap Wave

Data centers and AI infrastructure are already heavy users of rare earth magnets:

- Neodymium-iron-boron (NdFeB) magnets sit in server cooling fans, hard disk drives, and some power and networking components.

- Historically, hard disk drives have been one of the single largest uses of rare earth magnets globally, with hundreds of millions of units shipped each year.

- A recent analysis estimates that a hyperscale data center with around 100,000 servers can contain 5–15 metric tons of neodymium in cooling systems alone.

The AI boom is amplifying this. As cloud and AI workloads grow, the global data center market is projected to more than double in value this decade, and specialized AI clusters add even more high-performance hardware into the system.

Crucially for urban mining, data center hardware turns over fast:

Traditional server refresh cycles have averaged 3–5 years in many large environments, especially for high-performance workloads.

That means AI and data center equipment installed in the mid-2020s can start returning as magnet-rich scrap before 2030, well ahead of most EVs and wind turbines. Early pilots—such as programs that recover and recycle magnets from decommissioned hard drives—are already proving that this stream is technically recoverable at high rates.

If collection and dismantling are organized, AI and data centers can become the first large, steady flow of post-consumer rare earth magnets available to recyclers.

EVs and Wind: The Slow but Heavy Scrap Wave

EVs and wind turbines still dominate the forward demand projections for magnet rare earths. McKinsey estimates that demand for magnetic rare earth elements (Nd, Pr, Dy, Tb) will triple from about 59,000 tons in 2022 to 176,000 tons in 2035, driven mainly by EV motors and wind turbines.

However, these assets stay in service for a long time.

As a result, they behave like large, slow-moving “urban ore bodies”. Industry and IEA analyses suggest that:

- Around 2030, the first meaningful wave of magnets from early EVs and turbines enters the waste stream

- By the 2040s, magnets from retired EVs and turbines could represent a substantial share of all end-of-life magnets

- By 2050, they are likely to be one of the largest single sources of magnet scrap globally

So while AI and data centers create the first big scrap flows, EVs and wind add a second, heavier wave a decade or two later.

2035–2050: How Scrap Starts to Reshape Supply

By the mid-2030s, these dynamics show up in the system-wide numbers. McKinsey’s analysis of the rare earth value chain suggests that by 2035:

- Magnet production could consume about 176,000 tons of rare earths per year

- The value chain could generate roughly 40,000 tons of pre-consumer scrap (manufacturing losses)

- Plus around 41,000 tons of post-consumer scrap (magnets from end-of-life products across EVs, wind, electronics, and data centers)

In other words, nearly half of annual magnet material will appear somewhere as scrap.

If pre-consumer scrap is fully captured, and if collection and recovery of post-consumer magnets—especially from data centers, enterprise IT, and other electronics—are scaled, scrap could realistically cover around one-third of magnet rare earth demand by the mid-2030s.

Looking further out, the IEA’s recycling scenarios show secondary rare earth supply roughly tripling by 2050, with higher volumes again in a Net Zero pathway that assumes stronger circularity policies.

Policy and Market Signals: How Aggressively Are We Betting on Urban Mining?

Public-Policy Momentum

Urban mining is moving from a buzzword to an explicit policy target in many regions.

The EU Critical Raw Materials Act aims to expand domestic extraction, processing, and recycling of critical raw materials after highlighting the bloc’s heavy reliance on China for rare earths.

The UK’s 2025 Critical Minerals Strategy sets a specific goal: 20 percent of domestic critical mineral demand to be met via recycling by 2035. Countries including South Korea, Japan, several EU member states, and Canada are funding rare earth recycling pilots as part of national security and green industrial strategies.

In policy terms, recycling—and by extension urban mining—is now positioned as a core pillar of supply security, not just an environmental add-on.

Corporate and Investor Activity

Market participants are responding:

- Specialist recyclers such as Cyclic Materials, ReElement, and others are raising capital to scale magnet recycling facilities.

- Large technology companies, including Apple, Microsoft, and Western Digital, are developing proprietary disassembly and recovery systems to support their circularity and supply-chain resilience goals.

These moves signal that companies expect secondary rare earth supply to become strategically important and worth building around.

Urban Mining to Become A Billion-Dollar Market

Forecasts for the rare earth recycling market differ in exact numbers but align on direction:

Some analyses project rare-earth recycling to become a $1 billion–plus market by 2030. The broader urban mining market across metals is expected to grow at roughly 14 percent CAGR from 2025 to 2033.

Taken together, policy and capital are now pointing the same way: urban mining of rare earths is very likely to become a significant part of the supply mix.

The key questions for executives and policymakers are no longer if it will matter, but how large it can become and how quickly it can scale.

So… Can Urban Mining Actually Solve the Rare Earth Crisis?

Right now, urban mining covers well under 1% of global rare earth demand. On today’s trajectory, that’s not enough to move the needle.

But here’s the key narrative shift:

The small numbers we see today are a reflection of policy and system choices, not of physical limits. The urban mine is already big enough to matter — we just haven’t built the machinery to tap it.

Today: A Large but Underused Resource

Today, we are rapidly building up rare earth stocks in both the digital and energy systems:

- Cloud and AI growth is driving massive deployments of servers, GPUs, storage, and networking gear, all with magnets in fans, drives, and power systems.

- At the same time, EVs, wind turbines, and industrial motors are adding large volumes of magnet material to the installed base.

Yet most of this future “urban ore” is not being captured:

- Only a minority of global e-waste is formally collected.

- Even when hardware is collected, processes are designed to recover bulk metals like copper and aluminum, not rare earth magnets.

On charts, urban mining looks tiny because collection and recovery are limited. In reality, the urban ore body is already huge and growing, especially as AI infrastructure and clean energy assets scale.

The gap between what flows through the system and what we actually recover is where the upside for urban mining lies.

The 2030s: The Inflection Decade—If We Choose It

The 2030s are the likely turning point. Three trends come together:

On the digital side, servers and AI hardware refresh on short cycles—often three to five years.

Equipment installed in the mid-2020s can begin returning as magnet-containing scrap before 2030. Decommissioned data center gear can provide a steady, early flow of rare earth magnets if it is collected and dismantled in a structured way.

On the energy side, assets turn over more slowly, but the first cohorts arrive. EVs and wind turbines installed in the early 2020s begin to reach end-of-life, adding high-concentration magnets from motors and generators.

At the same time:

- Recycling technologies for magnet recovery move from pilot to commercial scale.

- Policy and price signals strengthen as more countries adopt critical mineral strategies and recycled-content targets.

2040–2050: Urban Mining as a Core Growth Engine

The most optimistic story for urban mining starts after about 2040.

By then, if we have:

- High collection rates for electronics, EVs, and wind turbines

- Product designs that make magnets quick and safe to remove

- A global network of magnet recyclers and refiners

then the structure of supply can shift:

- A large share of new magnet material each year can come from the urban mine, with AI/data center scrap providing fast, continuous flows and EVs/wind adding large volumes as they retire.

- Primary mining still exists, but it supports a moderately growing base instead of racing to match exponential demand.

- Countries with little or no rare earth ore can become meaningful suppliers by managing their hardware and e-waste streams well.

A simple way to think about it:

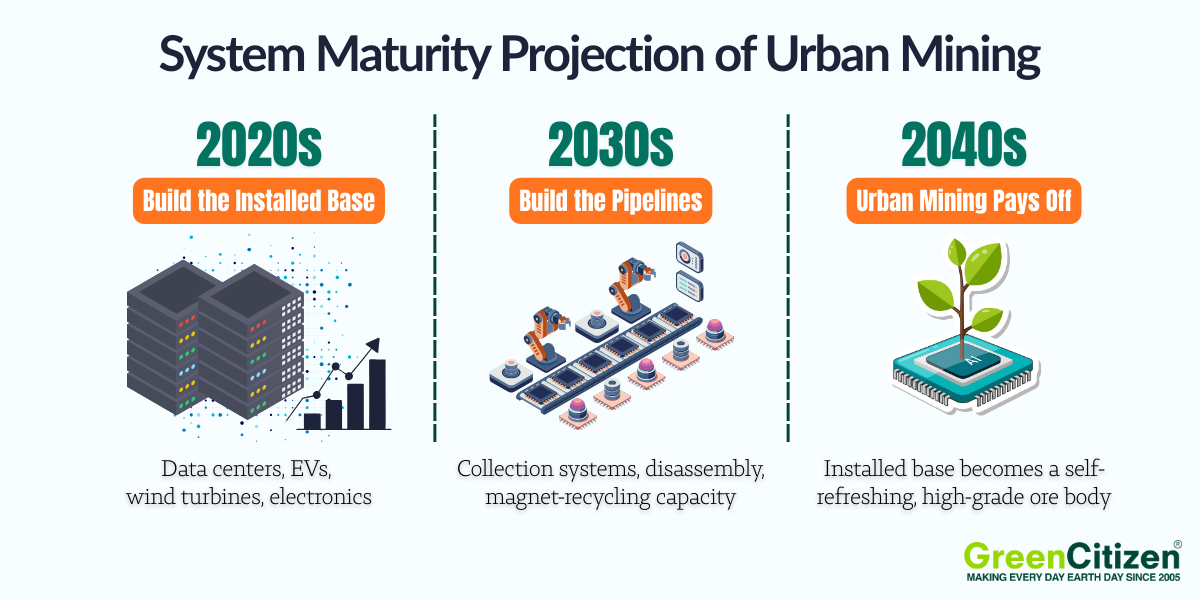

- The 2020s are about building the installed base (AI clusters, data centers, EVs, turbines).

- The 2030s are about building the pipelines (collection, disassembly, magnet-recycling capacity).

- The 2040s and beyond are when urban mining pays off, turning that installed base into a self-refreshing, high-grade ore body.

Viewed this way, the question shifts from: “Can urban mining solve the rare earth crisis?” to: “Will we build the legal, technical, and physical infrastructure in time for it to do so?”

That is a much more hopeful—and more actionable—framing for executives and policymakers deciding what to fund today.

Conclusion: Urban Mining Is the Only Solution That Scales With Demand

The rare earth challenge is often framed as a race to open enough new mines in enough new places. Our analysis suggests a different lens. Over the next decade, new mining, efficiency, and substitution are all necessary to keep supply and demand in balance.

But none of them scale with the technologies creating that demand. Urban mining—and, specifically, the emerging future of ITAD (IT asset disposition)—does.

The “urban ore body” is already material and will expand sharply as today’s EVs, wind turbines, data centers, and electronics reach end-of-life. As ITAD evolves from a compliance and data-security function into a strategic recovery engine for critical materials, it can sit at the center of this shift.

Policy is changing, technology is maturing, and capital is beginning to flow; the constraint is no longer whether urban mining can matter, but whether we build the collection, design, ITAD, and processing systems fast enough to capture its potential.